How to Make Feel Better When Front Cancer and Health Insurance

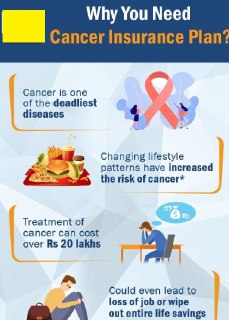

Breast cancer is her one of the most common types of cancer affecting women worldwide. It is estimated that 1 in 10 women are at risk of developing breast cancer in their lifetime. Although medical advances have improved survival rates, the financial burden associated with breast cancer treatment can be significant. Health insurance can play an important role in providing financial support during these difficult times.

This article examines how health insurance can help people diagnosed with breast cancer cover the financial costs of treatment. It also explains the importance of having the right health insurance and how to choose one that provides the protection you need.

Breast cancer and health insurance:

Importance of coverage

Breast cancer treatment can be expensive, especially in the United States, which is known for its high medical costs. And so on. In addition to these direct medical costs, there are also indirect costs such as hospital visits and loss of income due to unemployment. Health insurance can help alleviate some of these financial burdens. Health insurance may cover some or all of the costs associated with breast cancer treatment, depending on the type of insurance and the specific benefits it includes. For example, some health insurance policies may only cover hospital expenses, while others may cover a variety of medical expenses, such as doctor visits, prescription drugs, and diagnostic tests.

It's important to note that not all health insurance covers pre-existing medical conditions, including a history of breast cancer. This means that people diagnosed with breast cancer may not be able to get health insurance or have to pay higher premiums. But under the Affordable Care Act (ACA), insurers must cover people with pre-existing medical conditions, including breast cancer. Choice of health insurance:

Where to look

When choosing health insurance, it is important to consider the specific benefits included and the costs associated with the insurance. Here are some things to consider when choosing health insurance for the information:

Breast Cancer Treatment Coverage:

Make sure your policy covers breast cancer treatments such as hospitalization, surgery, chemotherapy, radiation therapy, and medications.

Out-of-pocket costs:

Consider any out-of-pocket costs associated with your policy, such as deductibles, co-pays, and coinsurance. Insurance with a lower deductible may have a higher initial cost, but can save you money in the long run if you need expensive treatment.

Network provider:

Check the policy's provider network to make sure it includes your preferred doctors and hospitals. Off-network maintenance can be significantly more expensive than on-network maintenance.

Prescription Drug Coverage:

If you need prescription drugs as part of your breast cancer treatment, make sure your policy covers them.

Maximum life:

Some policies may have lifetime medical cost caps, which may limit your coverage for breast cancer treatment. Check the maximum duration of the policy and make sure it is sufficient for your needs.

Breast cancer is a devastating disease that has a huge impact on a person's life, both emotionally and financially. Having health insurance can provide much-needed financial support during difficult times and help alleviate some of the financial burden associated with breast cancer treatment. When choosing health insurance, it is important to consider the specific benefits included and the costs associated with the insurance. Look for insurance that offers breast cancer treatment coverage, has reasonable deductibles, includes your favorite doctors and hospitals in your network, offers prescription drug coverage, and has the right maximum lifetime medical bills.

Covered by adequate health insurance

Individuals diagnosed with breast cancer can focus on treatment and recovery without the stress of financial burden. It's important to remember that health insurance not only protects your physical health, but it also protects your financial health.

There are also supplemental insurance policies that can provide additional financial assistance for breast cancer treatment. These policies such as B. Critical Illness Insurance. A lump sum is paid upon diagnosis of an insured person's illness. B. Breast cancer. This benefit can be used to cover all illness-related costs, including medical bills, transportation costs, and loss of income.

It is important to note that supplemental insurance should not be considered a substitute for comprehensive health insurance. They should be viewed as an additional layer of protection to provide financial assistance in the event of a covered disease or condition.

May help detect cancer early, before it spreads

Cancer screening tests play an important role in detecting cancer early, before it spreads and becomes more difficult to treat. Early detection is critical to improving cancer survival and reducing the need for more invasive and costly treatments.

Various cancer screenings such as mammography for breast cancer, colonoscopy for colorectal cancer, and Papanicolaou examination for cervical cancer are available. These tests can detect abnormal cells or growths that may be cancerous or precancerous, allowing early intervention and treatment.

It is important to note that screening tests do not detect all cancers, and screening tests do not always detect early-stage cancer. However, if you have regular cancer screenings, you are more likely to catch cancer early, when it is most curable. Besides cancer screening, there are several lifestyle factors that can help reduce the risk of cancer. These include maintaining a healthy diet and exercise routine, avoiding tobacco and excessive alcohol use, and protecting your skin from excessive sun exposure.

It is important to talk with your doctor about your individual risk factors for cancer and develop a screening and prevention plan that is tailored to your needs. By working with your health care provider and taking proactive steps to reduce your risk of cancer, you can increase your chances of finding cancer early and achieving better health.

In summary, early detection is critical to improving cancer survival and reducing the need for more invasive and costly treatments. Cancer screening tests help detect cancer early, allowing early intervention and treatment. In addition to regular cancer screenings, lifestyle factors such as eating healthy, exercising regularly, and avoiding tobacco and excessive alcohol consumption also help reduce the risk of cancer. By working with your health care provider and taking proactive steps to reduce your risk of cancer, you can increase your chances of finding cancer early and achieving better health. Remember, prevention and early detection are key in the fight against mumps.

Open Comments

Close Comments

Post a Comment for " How to Make Feel Better When Front Cancer and Health Insurance"